Renovation & Retirement: Is It Cost Effective?

If you’re a retiree, you know this story all too well: with retirement comes a fixed income. Oftentimes, an affordable home renovation sounds appealing to retirees because they’re looking to get more bang for their buck. Renovation can increase a home’s value, its energy efficiency, make a home easier to sell, and strengthen your neighborhood’s property value.

But as a South Carolinian retiree, is a home renovation really right for you? Let’s go over the pros and cons of renovations together.

Increased Value

A well thought out renovation can increase your home’s value. It’s harder to make money on a remodeling project that doesn’t focus on a design flaw or a structural issue, but it’s not impossible.

You can increase your property value if you choose the right project.

From Investopedia:

“Historically and on average, certain projects, such as the addition of a wood deck, kitchen and bathroom upgrades and window replacement, have shown the greatest ROI regardless of the property’s location or the state of the residential property market.”

The article also goes on to note that if a homeowner plans on selling, they should plan on catering to the taste of prospective buyers. Think about the last two families who moved into your neighborhood. Why do you think they chose those homes?

If you’re planning on selling, you can even go so far as to ask your neighbors what they like about their current homes and what they like about the neighborhood. You can then pass some of your construction expenses onto future owners, because your property value will go up and your improvements will appeal to those prospective buyers.

Consult local real estate guides to see which projects are most likely to pay for themselves. If you’re not selling, a new deck or bathroom might have a huge positive impact on your overall quality of life. But always remember that the value you get from a renovation might be different than the value a prospective buyer sees.

Energy Efficiency

An affordable home remodel can also save you money if you focus on energy efficiency.

Windows, insulation, HVAC systems, and water systems can all save on energy costs if the right materials are installed by a professional.

New windows often add value to a home, and they can also reduce power costs, thus stretching your fixed retirement income even further.

From The US Department of Energy:

“If your home has very old and/or inefficient windows, it might be more cost-effective to replace them than to try to improve their energy efficiency. New, energy-efficient windows eventually pay for themselves through lower heating and cooling costs, and sometimes even lighting costs.

When properly selected and installed, energy-efficient windows can help minimize your heating, cooling, and lighting costs. Improving window performance in your home involves design, selection, and installation.”

Insulation can make a big difference, too. According to the North American Insulation Manufacturers Association, “Insulation saves over 600 times more energy each year, than all of the compact fluorescent lights (CFLs), Energy Star Appliances, and Energy Star windows combined.”

A good air conditioning system and an efficient water heater are important, too, especially in communities predominately populated by retirees.

Some families also install solar panels and solar water heaters to boost energy efficiency even further.

Some energy efficiency renovations even include a nice tax credit from Uncle Sam as well!

From TurboTax:

“… if your home-renovation projects include the installation of energy-generating equipment, then you may get some relief by claiming a tax credit. Even if you don’t qualify, at least you can reduce your taxable gain when you sell the home by the cost of the renovations. Remember to file away and keep all receipts.”

If you’re planning on staying in your home, energy efficiency is a great way to save money in the long run and make your fixed retirement income work even harder for you.

Curb Appeal

Curb appeal usually refers to “The general attractiveness of a house or other piece of property from the sidewalk.” It goes much deeper than that, though.

When considering buying a home, curb appeal is what people keep in mind. The exterior is the most important part, but other factors come into play as well.

From Investopedia:

“Items that add curb appeal help the property to look good when prospective buyers arrive. While these projects may not add a considerable amount of monetary value, they will help the place sell faster. Curb appeal items include a nice green lawn, attractive landscaping, fresh paint inside and out, new carpet and new appliances.”

If you’re planning to remodel, sell your home, and make money, then having a beautiful home exterior is essential. Do people in your neighborhood admire your home? Do they comment on it?

If the answer is yes and you’re still looking to remodel, ask your neighbors what they would change or add to the exterior of your home when considering a renovation.

You’ll want to make sure you have nice gutters and spouts, make sure your roof doesn’t leak, make sure you have a solid foundation and nicely maintained walls, and consider other common sense items.

If you plan on selling in the near future, pay attention to other home prices in your area so you don’t over-renovate and potentially lose money.

Projects that add resale value are:

- new kitchens

- bathroom remodeling

- windows

- siding

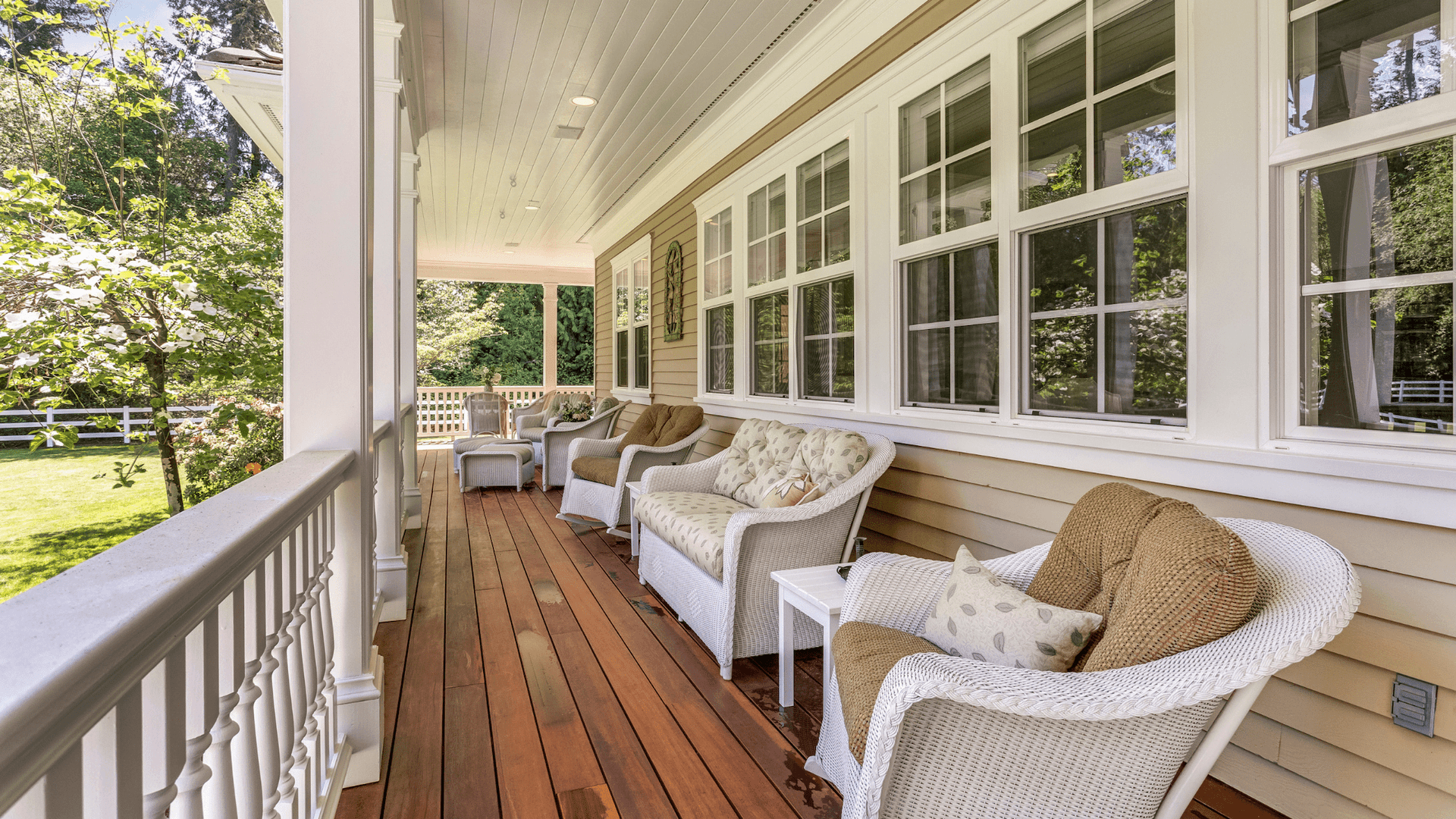

- decks

If you’re looking for resale value, strongly consider the outside of your home. Exterior renovations, like siding, don’t go out of style or become obsolete nearly as quickly as inside renovations, and the right kind of siding can actually make you money on a remodel project.

Fiber cement siding from James Hardie, for example, can offer a huge Return on Investment. According to Cost Vs. Value report, installing James Hardie fiber cement siding offers 103.1% cost recuperated in Charleston.

We are the only Elite Preferred Hardie Installer on the Carolina Coast. We can help you with fiber cement siding, if you decide to go down that road.

So, is a renovation cost effective for you, the retiree? If you’re looking to sell your home, focus on the correct areas, but you’ll need to do the math. Pay special attention to home prices in your area, and always consider your perceived value vs. a buyer’s perceived value. When you’re planning to sell, always renovate with the buyer in mind.

If you’re not planning to sell, improving your home’s energy efficiency might be the way to go.

Affordable home renovations are great for retirees to get more bang for their buck, if you do your homework.

All great remodels start with finding a great contractor.

We can help. Use our free “Contractor Standards Guide” to help find the perfect contractor for your next affordable home renovation.

Premeditated Excellence

Randy Hann

Get A Free Estimate!

Recent Posts

Latest Home Owner Trends & Resources

The serene coastal settings of Myrtle Beach and Charleston are perfect for blending the comforts of indoor living with the natural beauty of the...

In a significant industry acknowledgment, Contract Exteriors has been honored with the 2024 BBB Torch Award, a symbol of trust and integrity...

In the coastal cities of Myrtle Beach and Charleston, selecting the right decking material is crucial due to the unique challenges posed by the...